#1 - Chain Reaction

Bear Market Survival Guide: Strategies to Secure Your Funding 🐻📈💰

Editorial - Welcome to Chain Reaction ! 🚀

Hey there, web3 builders !

Thanks to read the inaugural edition. We're your co-captains, navigating the ever-evolving web3 currents alongside you. This week, we're diving deep into the bear market waters. We get it - times are tough, but that doesn't mean the web3 is over. In this edition, we've got your back with a treasure chest of tips and tricks on how to source funding even when the market's taking a dip. 🐻💰

We want this newsletter to be your weekly dose of inspiration, guidance, and actionable insights to create opportunities for your project.

Thank you again for joining us on this thrilling journey.

Romain & Vincent, Co-Founders, Chain Reaction

Let’s start with a meme 👷🏻♀️ 🐸

On which side are you ?

3 reasons why you should continue sourcing candidates

1️⃣ Talents are looking for new opportunities. Some are looking to leave ships that are rocking or that have already said "Thank you". This is a golden opportunity to recruit those who might be out of reach in bull market. 💎

2️⃣ Those who join your project now are there for your vision, not just for the value of the token. They're the long-term contributors you're looking for. 💪

3️⃣ Building your team now means preparing for the next bull market. When the wind shifts, you'll be ready ! Remember that shooting windows are short and versatile in the web3 🚀

Conclusion :

Sourcing and searching for rare profiles must be your leitmotiv, no matter what phase of the cycle we're in.

Activable tips in the premium part of the newsletter.

🔥 The weekly hot topic 🔥

Strategies to Secure Your Funding 🐻📈💰

Ah, the bear market, this wild beast that roars in the dark corners of finance! It's a time when prices are falling and confidence is crumbling, but believe it or not, it's also a period full of unexplored opportunities for web3 startups: the competition is crumbling, talents become more accessible, and the investors you are going to attract will be qualified and will have a real fit with your project.

A. The Specificities of Web3 in Financing

In the colorful world of web3 🌐, financing is somewhat like a molecular cocktail, with ingredients such as Equity (Capital provided by shareholders) and tokens.

You can have an Equity + Token cocktail which is a direct mix: the investor provides capital and at the same time purchases tokens delivered later. You can have an Equity + Token option cocktail, a bit more sophisticated : here the investor will have the right in the future to buy your token at a preferential price if he wishes. Do not hesitate to adjust the dosages between Equity and Token until you find the ratio that will please your investors.

And for those who like adventure, there are Token sales, in different forms that you already know well: SAFT when the token is not yet issued, OTC for over-the-counter sales, Sale on the markets with a good trading algo... it's kind of a token party! This financing modality is clearly the bitterest at the moment given the low valuations of tokens in bear. Your stock of tokens must quench your project for many years... be careful to avoid evaporation 💨.

And then, there are the DAO Grants, a bit like those gifts you did not expect to receive 🎁. They allow projects that are part of an infrastructure or an ecosystem to benefit from project development assistance, usually in the form of tokens. Applying is a great way to connect with these ecosystems... which also generally have investment funds to introduce you to. However, note that the amounts paid are generally calibrated to lend a hand to Early stage projects but will not allow you to conquer the world 🌍.

And let's not forget the weight of the community. It's like having a crowd of admirers who support you, a significant asset in this entrepreneurial journey: they are proof of your traction, they are the ones who buy your tokens... And increasingly those you are going to seek to invest in equity.

Let’s take YOUR temperature 🥶 🥵

B. Why is it hard ?

But here’s the thing 🤔, when the bear market knocks on the door, the tech party kind of stops. Capital becomes as scarce as water in the desert, and selling tokens becomes as difficult as selling ice cream in winter. The hype has died down and investors turn into turtles, hiding in their protective shells. It's also a return to more rationality after some intoxication of the past years.

There are some beautiful counterexamples of token sales from projects that have managed to create an event in this gloomy context. This is for example the case of the launch of the EDU (Education Protocol) by Animoca Brands on Binance's launchpad which had raised 2.5 Musd 💰. However, the approach remains risky ⚠️ if you do not have the firepower of these actors... Just remember that there is no absolute truth 🤷♂️.

C. How Complicated is it Going to Be ?

So, how hard is it, you ask ? Imagine you are an aspiring rocker🎸. In the beginning, in pre-seed/seed, you need a good team (your band) and demonstrated growth potential (your fans). It's a bit like having a good demo and a few sold-out gigs. For now, aspiring rockers are still well followed like Only Dust or BubbleMap, who each raised 3m€.

But as you progress through the funding rounds, you need to secure your profitability, meaning proving that you are not just a one-hit wonder🎤. Exponential turnover is no longer enough; you have to show that you know how to manage your band and that you are capable of filling stadiums ! For example, we can mention the series A raise of 12MUSD by Hyper Play... founded by Consensys, which certainly helps💰.

A CEO Point of View :

The CEO of BubbleMap, Nicolas Vaiman, testifies on LinkedIn about the difficulties encountered and shares his tips📈: it’s hard but not impossible.

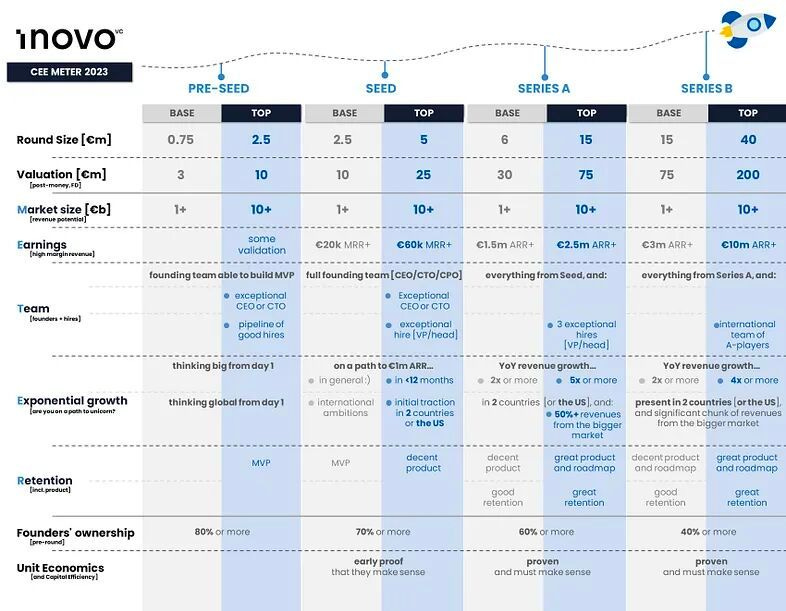

A VC Point of View, Philippe Roche :

Where are you in this document ? OK standards of VCs are not reality, but it will help you to outline your advantages and limits :

D. The Action Levers to Activate

🌟 Exclusive for Premium Members Only:

💰 Funding:

🧭 Navigating Your Investor Journey: Discover tools, curated lists of investors, and strategies to connect with the right partners for your venture.

🌟 5 Examples of Success: Delve into successful strategies that have propelled startups to new heights.

📊 Pitch Perfect: A refresher on the crucial elements of your pitch deck, illustrated with examples to help you make a lasting impression.

👥 Human Resources:

📉 Leveraging the Bear Market: Explore actionable strategies across three levels, tailored to your resources, to turn market lows into opportunities for growth.

🔒 Satisfaction Guaranteed:

🔄 Not finding value in your premium subscription ? Send us an email within the first 15 days expressing your concerns, and we’ll be more than happy to process a refund for you.

Increase Your Chances: Bet on Quantity and Quality 🎯.

To increase your chances, it’s like playing on several stages at once. Consult numerous funds, especially those who continue to believe in web3 (they do exist), expand to long-term vision family offices, and go back to see the BA. Operate by iteration, send a batch of decks, capitalize on the feedback, and start again.

Searching for a revolutionary tool to pinpoint the top opportunities 🎯? (no sponsoring)

https://signal.nfx.com/investors helps you find investors that match your profile and identify who can connect you to them within your network 🌐.

You also have traditional lists on the web (When it is possible, contact the analyst on LinkedIn):

Top 400 Family Office Investors - provided by Aram Mughalyan

29 Web3 VC

330 Grant Programs

Attract non-dilutive to reassure equity investors. It’s a bit like having a sponsor while selling T-shirts on the side 🎽. In each country, there are reference actors to help you find grants and enter contests that agree to be paid in success fees.

Can't attract after finishing the list? Isolating a single piece of your project could be the key 🔑, especially if you are already at an advanced stage of maturity but investors do not wish to enter your company as it is. This allows attracting investors to a fundable aspect of your startup while keeping an option on the other dimensions of your projects during a resumption of activity. Concretely, you create a new entity that will have to raise its own funds and will be more likely to do so than its parent company because it will be on a segment attractive to investors, you may have brought in a key partner's capital before launching the raise.

And when all seems lost ? Well, there's always a way to save the day 🚀. Preparing a post-bankruptcy recovery with partners can be an unexpected lifeline. In any case, remember that you are pioneers and that falling and getting back up is part of the process 💪.

E. Examples

Company A, Early stage:

Imagine a startup, full of vigor and ideas, let's call it "AlphaTech" 🌱. It's in the world of web3, with dreams of changing the way we interact with technology. AlphaTech, in the Early Stage, was like a child in an amusement park, exploring the roller coasters of grants and building a solid community. The days were long, the nights short, but small successes were beginning to accumulate. The pre-seed round was a success, thanks to a clear vision and a passionate team. In Early, you start on the new market conditions, certainly demanding, but you will still find funds: it's up to you to prove that you are the best. It's a bit hard, but it's better than being in other situations 😊

On LinkedIn, Malcom Lewis remembers us the objective of each slides of a pitch deck:

Company B, Strong Community can buy token… or Equity :

Next, we have "BuzzChain" 🐝, a bold project with a community so strong it could move mountains. They looked at the traditional path, then decided to take the less traveled path of crowdfunding, drawing inspiration from the success of Swissborg. Their community, their greatest asset, was the wind in their sails, propelling them towards new and exciting horizons. Community doesn’t think like VCs and it could be you’re chance.

Don’t hesitate to learn form the landing page of the crowdfunding : https://swissborg.com/launchpad/swissborg-series-a

Company C, Long Term R&D:

Meet "CryptoConstruct" 🧪, a company immersed in L2 R&D , with lab glasses and whiteboards everywhere. No growth demonstrated yet, but an untamed spirit. They dug deep into the world of public funds and contests. Admittedly, public funds were like a side dish, but they added a necessary flavor to their entrepreneurial culinary journey.

Example: BPI project calls in France.

Company D, Scattered:

Here is "DiverseTech" 🌐, an eclectic mix of ideas and projects. A bit everywhere, but with flashes of genius. They decided to highlight their best assets in an SPV, attracting investors to specific and promising aspects, while letting other ideas simmer in the background. Focusing on isolated activities could be salutary for the rest of your entrepreneurial adventure, even if the rest of the activities perish in the end.

Company E, All is Lost:

And finally, "EndGame Tech" 🕳, the company that has seen the bottom of the abyss. They looked bankruptcy in the eyes and decided to fight. With post-bankruptcy recovery files and solid partners, they have redrawn their destiny, finding a glimmer of hope in the darkest moments.

Conclusion

We let you build your own conclusion, some questions to help your with this challenge :

🌐 Which specific financing modalities have you explored, and how does each option align with the long-term vision and goals of your web3 startup?

💰 How are you adjusting the ratio between Equity and Token to maximize value for investors while preserving the integrity and mission of your company?

🌟 What concrete strategies are you using to build and maintain a strong and engaged community, and how do you measure the effectiveness of these strategies?

🔍 How do you identify and isolate specific and promising aspects of your project to attract investments, and what are the implications of this isolation for the rest of the company?

🔄 What plans and partnerships do you have in place for post-bankruptcy recovery, and how do these plans contribute to the resilience and sustainability of your company?

📈 How do you concretely demonstrate profitability and effective management of your company to secure long-term financing, and what metrics do you use to assess these aspects?

🔄 How do you integrate investor feedback to refine your value proposition and continually improve your financing approach?

Back to our sourcing topic 🧐💡

Did you know that a few months ago, Coinbase laid off 950 people, but above all did everything in its power to help them find new jobs in the web3 industry as quickly as possible? Here's the kind of talent opportunity your project could seize in the coming months. Stay tuned 😉

Now lets’s discover effective talent sourcing strategies in the Web3. From leveraging GitHub contributions to engaging with decentralized autonomous organizations, we've curated a range of affordable strategies to help you find top Web3 talents even in challenging market conditions.

Never forget that sourcing must be a continuous flow, and that it is very dangerous to go from mode 1 (in bull run) to 0 (in bear market). These actions below can help you maintain a presence as an attractive employer even if you have no open opportunities in the short term. Remain sexy in candidates' minds !

Easy to implement 😁

Moderately easy to implement 😃

Hard to implement 😅

🚨 Last but not least 🚨

Of course, we chose to steer clear of the external sourcing route, as we were on a quest for budget-friendly solutions. But if you're feeling like recruiting is a puzzle waiting to be solved, here's a piece of advice.

Think of it as assembling a roster of 5 to 10 star players who will be ready to take the field when the time comes. Forget about success fees – this isn't a race to the finish line. Instead, consider compensating your recruitment expert based on their invested time, akin to paying for hours spent excavating buried treasure. Alternatively, you could craft a compensation scheme based on the rarity of the profiles they unearth. Imagine shelling out between 0.5 and 1 K€ for each unique gem they bring to light. It's like paying for collector's items, only these treasures are living, breathing talents!

Another option is to use a low-cost technical recruiter, such as profiles you can find on Upwork. Your subcontractor can then send you a list of several hundred Linkedin profiles, more or less qualified. It's then up to you to sort them out, and decide whether or not to keep the initiative for the first contact, depending on the level of trust placed in the sourcing person. This can reduce the cost of extensive sourcing by a factor of 3 or 4.

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.