👾 Why investing in a Blue Chip NFT PFP can be an excellent marketing strategy ?

And 3 tips to avoid token dump 🚫💸

Today's Agenda...

Blue Chip NFT PFPs can provide a chance to boost your personal branding and project marketing. 🌊🔵

Avoid token dumps with strategic tokenomics, withdrawal delays, and positive stakeholder relations. 🚫💸

⏰ Reading Time: 6 min

Join the Web3 Leaders Community

Like the entire crypto market, the NFT market has also suffered over the past 2 years, but today it offers even more opportunities for you to boost your personal branding as a web3 leader, and thus that of your project or company. 🎨💰 So what about investing in a high-priced Blue Chip NFT PFP (Profile Picture)? Is it the secret sauce for a marketing masterpiece ?

Diving into the Blue Chip Wave 🌊

Bluechip NFT PFPs, often adorned with unique, eye-catching designs, have become a status symbol in the crypto space. While their initial price tags might seem steep, the investment can prove to be a game-changer for your personal branding. 🔵💼

What are those collections and their current floor prices ?

Here is a list of the main 6 iconic collections with their floor prices on January 30, 2024 :

Macro market perspective with Jean-Michel Pailhon

Jean-Michel Pailhon is one of the world's leading experts and collectors of Digital Art. He co-founded Grail Capital to help institutional investors get into digital art.

“The PFPs constituted the initial market fit for NFTs during the 2021/2022 period, enabling NFTs to gain critical mass, led by the pioneering collection of CryptoPunks. According to our estimations at Grail Capital, based on October 2023 OpenSea data, PFPs accounted for 66.5% of the digital art market.

However, PFPs also experienced the most significant floor price decline during the bear market, in contrast to generative art, which demonstrated better resilience. In this scenario, Blue Chip collections fared better, highlighted by the impressive performances of CryptoPunks and Pudgy Penguins over the past year.

Clearly, PFPs are here to stay as they appeal to everyone, unlike Art NFTs. For instance, Pudgy Penguins cater to the very young, while Azukis appeal to Manga culture enthusiasts.”

Chain Reaction thanks Jean-Michel for taking time with us.

Why Opt for Blue Chip NFT PFPs? 🤔

1. Unmatched Visibility:

Blue Chip PFPs are social currency in the Web3 landscape. Owning one instantly elevates your brand's visibility within the crypto community and beyond. 🌐🚀

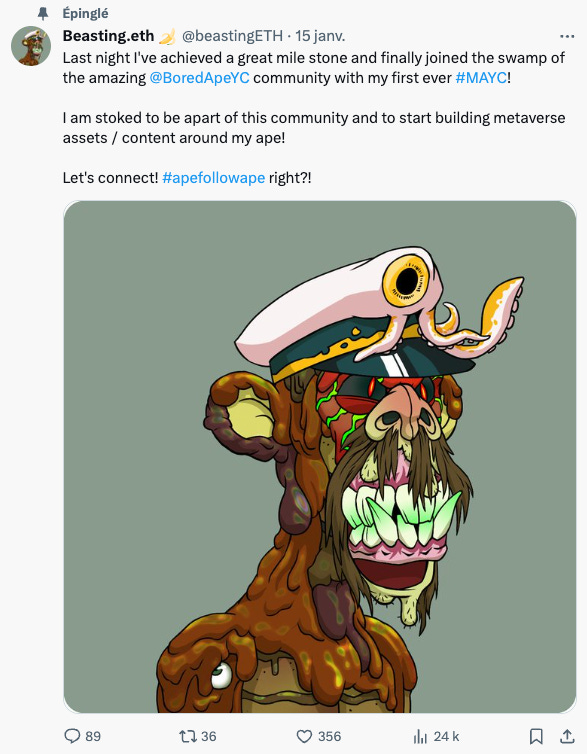

If we take the example of this twitter account, which belongs to a metaverse studio co-founder, joining the MAYC community has clearly boosted engagement on his twitter posts, which previously only counted a few hundred views.

2. Built-in Community:

These NFTs often come with exclusive access to communities filled with like-minded individuals, potential clients, and industry influencers. It's not just an image ; it's a ticket to a thriving network. 👥🔗

To illustrate this added value, we interviewed the CEO of a web3 consulting agency, who also acquired a MAYC several months ago. He wished to remain anonymous:

"This acquisition has been one of the best marketing investments for our agency. My participation in the ApeFest in Hong Kong in November was the best networking event of my life. I was able to meet many founders of web3 projects and talk directly with a co-founder of Yuga Labs".

This Apefest participant was able to meet and chat with Yat Siu, Chairman of Animoca Brands, and Greg Solano, co-founder of Yuga Labs.

Comparing Costs: NFTs vs Traditional Marketing 📊

Yes, the initial investment might raise eyebrows, but when weighed against traditional marketing costs, the value becomes clear. In fact, a marketing campaign built with a triple A web3 agency will also cost you several tens of thousands of euros, and it's a "one shot" operational expense. Your NFT is an asset that lasts over time, unless of course the collection depreciates significantly.

All investments involve risk 🚨

It must be said that the aim of this article is to present the opportunities of investing in a Blue Chip as a marketing expense. Above all it remains an asset and as such it can depreciate. A striking example is that of the Azuki collection, which saw its image deteriorate sharply following 2 events:

-in May 2022, a controversy targeting Zagabond, one of Azuki's co-founders, led to a drop of around 10 ETH in the project's floor price. Read more here.

-in June 2023, the mint of the Azuki Elementals collection, judged to be too close to the original Azuki collection and diluting its value, also led to a halving of the floor price. More information here.

In conclusion, while the initial cost of a Blue Chip NFT PFP may give pause for thought, the long-term benefits to your marketing efforts are undeniable. The unique blend of visibility, community access and potential for viral success makes it an investment worth pondering. 🌐💎🚀

3 Tips to avoid token dump 🚫💸

Launching a token is complex, but keeping it alive is also a great challenge. Every project's fear is to see their token massively dumped.

Your best protection, of course, is to build with a long-term vision, which is what your community expects. However, the crypto markets can shake up any project.

Here are 3 tips to limit the turmoil:

1- Pay Attention to the Basics 🛠️:

Carefully plan your tokenomics and, more importantly, manage it over time; align your marketing calendars with unlock schedules. The classic move? Launching a staking program to buy some time before more impactful technical or client announcements.

Choose a good market maker and challenge them on their market tracking methods: are they able to detect significant orders? Can they act and place their orders beforehand?

2- Create visibility while moderating certain movements 🌐:

When possible, put 'lockers' in your protocols to transparently apply a delay between the time your user requests a token withdrawal and the transaction completion.

This is a common practice in DEFI or infrastructure but can also be useful for some of our clients, for example in gaming when withdrawing earned tokens. This delay allows you to monitor additional liquidity that might be dumped on the market.

3- Maintain good relations with whales and assist them in liquidation 🐳:

Most projects are well aware of their whales, which generally emerge during private sale phases.

It's in their best interest to occasionally interact with them to maintain a trustful relationship and can offer their services when they want to sell their tokens.

This could involve a gradual liquidation managed by the market maker or a buyback of the tokens by the project if its liquidity allows it through an OTC deal.

In conlusion, there's no miracle, but these practices are part of the points to deploy for a healthy management of your token. Share in the comments the limits of these approaches and points to add!

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.