💥 Top VC scams : don't let your project be the next victim

And a quick guide to on-chain token distribution

Today's agenda...

How to spot fake investors in web3: learn to recognize their top scams and protect your team from costly traps 🎭🔍

On-chain token distribution: essential tools and strategies to ensure transparent, efficient, and legally compliant distribution 🚀📊

⏰ Reading time : 5 min

Join the Web3 Leaders Community

Fake investor playbook : tactics to keep you hooked

These scammers aren’t amateurs—they play the long con. Their process is gradual, beginning with a professional front. They set up meetings, calls, and may even arrange in-person meetups across borders 🌍. By carefully building trust, they aim to make you emotionally invested, often enough to overlook warning signs.

When web3 teams engage with these fake investors, they often end up wasting not just time, but money and resources on empty promises.

Top investor scams to watch for

Token swap trap 🎭

These scammers promise to buy your tokens in exchange for other crypto assets. They initiate a “test transaction” with a small but enticing amount and, after gaining your trust, either send fake tokens or vanish altogether. They often operate at crypto conventions, blending in with real investors 🪄.

Advance fee fakers 🚫

These fraudsters engage in lengthy conversations to build trust, culminating in a sudden request for “fees” to release funds—typically for legal or compliance reasons. Of course, the promised funds never appear. Remember, if the deal seems too good, it’s probably a mirage 🤔.

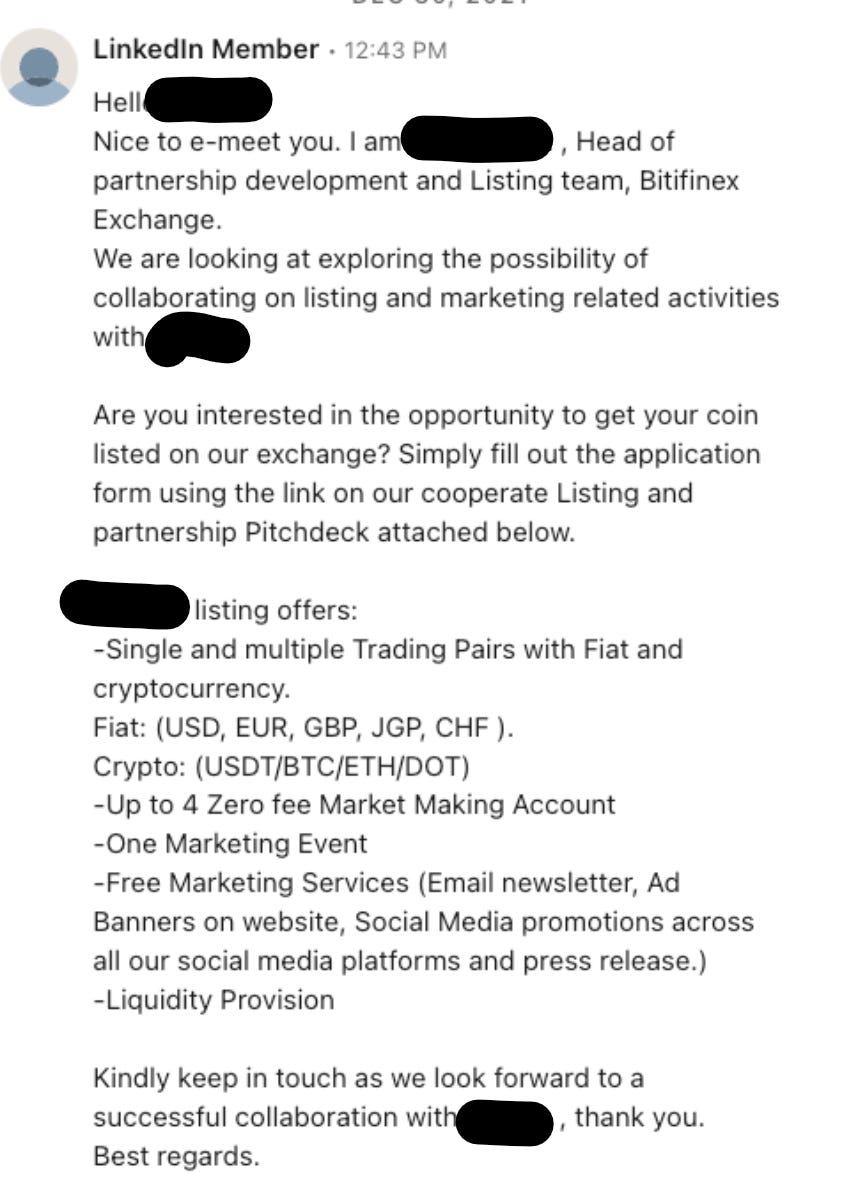

Ghostly exchange rep 👻

Posing as a representative from a top exchange, these scammers push you to pay listing fees. Once payment is sent, they disappear, leaving you with no listing and no way to trace the funds. Beware of slightly misspelled names, like "Bitifinex" instead of Bitfnex!

The ‘Urgent’ exec request 📧

This scam hits close to home, where a team member receives an urgent email supposedly from a top executive, often sourced from LinkedIn. The imposter requests immediate funds for an “emergency.” Always double-check these types of internal requests to avoid costly mistakes.

A CEO’s guide to avoiding fake investors 🔍

Protecting against scams takes more than just gut instinct—here’s how to take a proactive approach to investor vetting:

Background research: start with a LinkedIn check. Look for mutual contacts, examine work histories, and confirm media mentions or other credentials. Double-check their company presence 📊.

KYC and KYB checks: trust but verify. Conduct Know Your Customer (KYC) and Know Your Business (KYB) checks on any prospective investor to ensure they’re legit 🧾.

Demand references: legitimate investors will provide references. Reach out to these contacts to confirm the investor’s track record and credibility 📞.

Consult legal experts: before signing anything, get legal advice to verify terms and ensure you’re within regulatory bounds ⚖️.

Stick to secure channels: use traceable, secure channels for sensitive information and avoid discussing project details on unverified messaging platforms 🔒.

Tap into the web3 network: engage with other startups and share notes on investor experiences. By pooling knowledge, you’ll be better equipped to detect similar scams early on 🤝.

*affiliate link

On-chain token distribution, a quick guide

Effectively managing and monitoring token distribution on-chain is crucial for the success and integrity of any web3 project. Drawing from practical experience, here are key strategies and tools to ensure a seamless distribution process and maintain transparency with your community.

1. Develop a comprehensive token distribution plan (if it’s not too late…)

Begin by outlining a clear token distribution strategy that specifies allocations for team members, investors, advisors, and the community. This plan should detail the total token supply, distribution percentages, and any vesting schedules. A well-structured plan not only fosters trust but also aligns with the project's long-term objectives. Don’t hesitate to organize an AMA to explain it again and again at key moments of your distribution plan : clear communication is crucial to avoid negative reactions from holders.

2. Utilize on-chain vesting contracts

Implementing on-chain vesting contracts ensures that token releases occur transparently and according to predefined schedules. Platforms like Streamflow offer customizable vesting solutions, allowing you to tailor release schedules to your project's specific needs. These contracts enhance security and reduce the risk of unauthorized access or fraud.

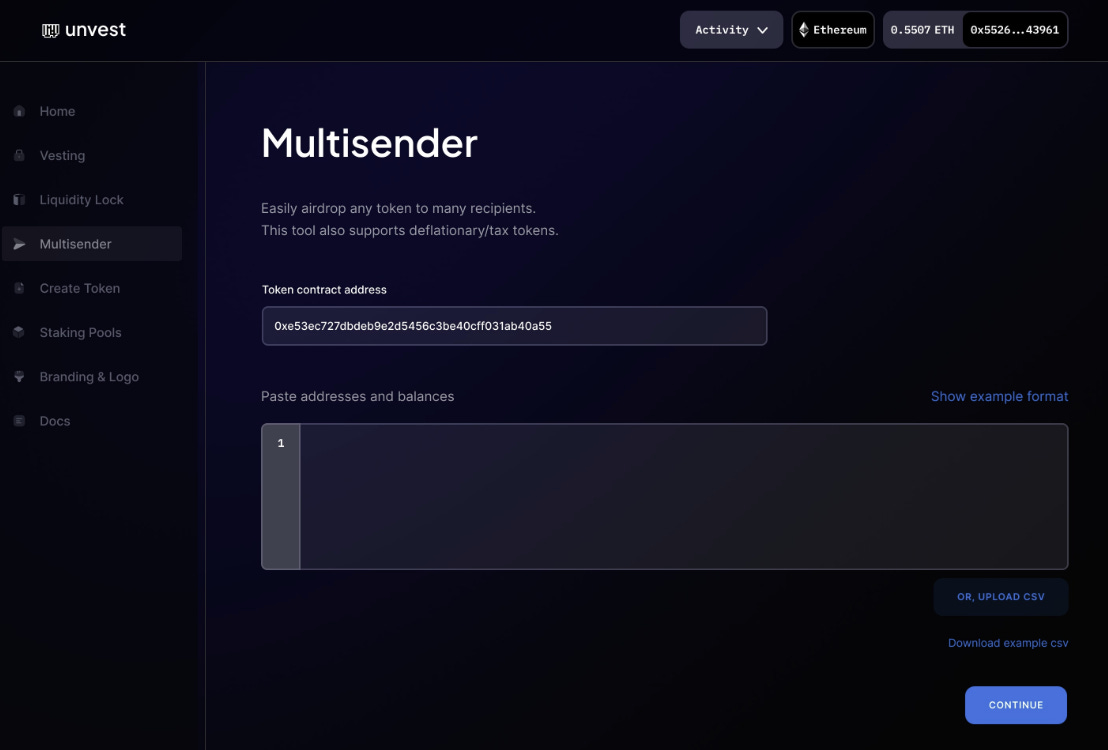

3. Employ multisender tools for efficient distribution

Distributing tokens to a large number of recipients can be time-consuming and error-prone. Multisender tools, such as Unvest's Multisender, enable batch transactions, streamlining the distribution process. These tools often provide real-time analytics, offering insights into each distribution phase and ensuring accuracy.

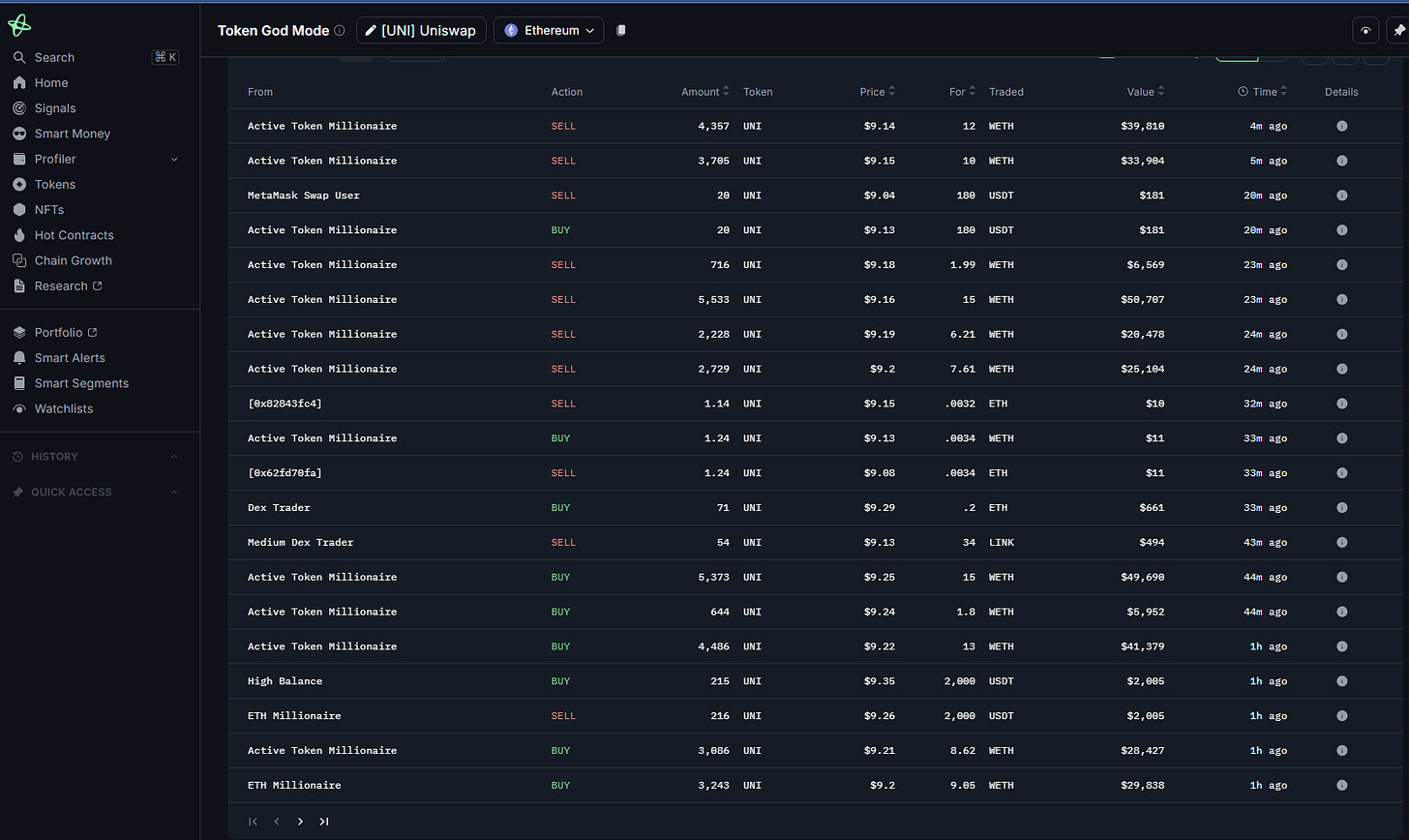

4. Leverage on-chain analytics platforms

Monitoring token distribution and movement is essential for transparency and trust. On-chain analytics platforms like Nansen allow you to track token flows, identify large holders, and understand transaction patterns. These insights can inform strategic decisions and help detect any unusual activity.

5. Ensure regulatory compliance

Adhering to legal and regulatory requirements is paramount. Different jurisdictions have varying laws regarding token distributions. Consult with legal experts to ensure your distribution methods comply with applicable regulations. Resources like Legal Nodes provide guidance on structuring token distributions legally.

6. Maintain Transparent Communication

Keep your community informed about distribution schedules, vesting periods, and any changes to the plan. Transparent communication builds trust and encourages active participation. Regular updates through official channels can prevent misinformation and foster a loyal user base.

Common Pitfalls to Avoid

Over-allocating to insiders: allocating too many tokens to team members and early investors can lead to centralization and potential market manipulation.

Neglecting legal considerations: overlooking regulatory requirements can result in legal complications and damage to your project's reputation.

Poor communication: failing to keep stakeholders informed can erode trust and hinder community growth.

In summary, practical management of on-chain token distribution involves meticulous planning, the use of specialized tools, adherence to legal standards, and ongoing engagement with your community. By implementing these best practices, you can set a solid foundation for your project's success.

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.