🔍 The only 6 tools you need to master crypto analytics

And how to build an operating plan for your web3 startup

Today's Agenda...

Track crypto like a pro with these 6 essential tools for insights and smarter decisions 🚀📊

Master your web3 startup’s growth with a simple, adaptable operating plan 💼🚀

⏰ Reading Time: 5 min

Join the community of web3 leaders

6 essential analytics tools to track crypto data and make smarter decisions 🚀

Whether you’re tracking DeFi performance, tokenomics or on-chain activity, these platforms will provide you with actionable insights. Let’s explore the 6 must-have tools and their killer features:

1. DefiLlama – TVL tracking made simple

DefiLlama is the go-to platform for tracking Total Value Locked (TVL) across DeFi protocols. But also stable coins, ETF, hacks, fees, yields data, etc.

Its killer feature ? The ability to break down TVL by chain, protocol, or category, offering unmatched clarity on where capital is flowing in the DeFi ecosystem.

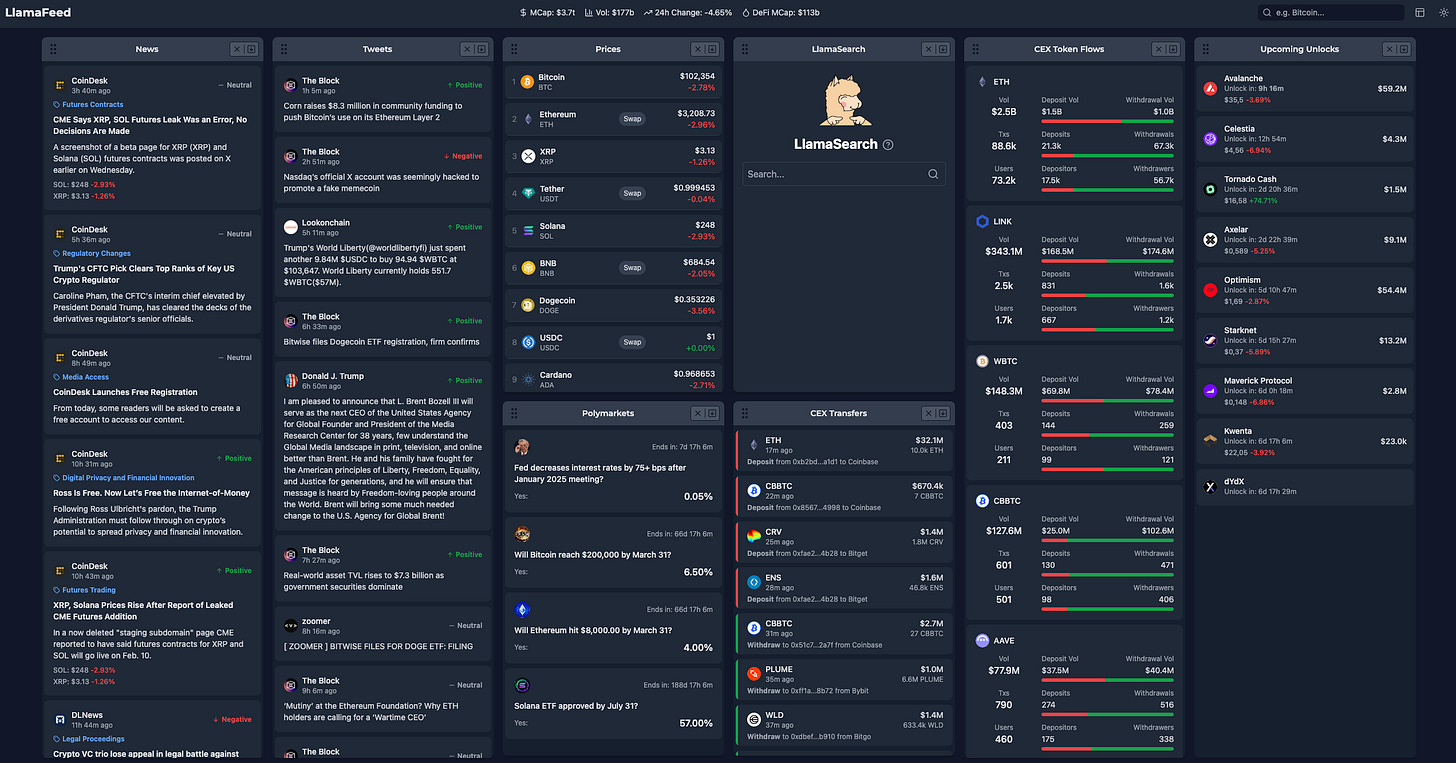

We're also particularly fond of the real-time feed they've just created, which gives you a highly successful visual summary of the market data you're interested in 👇

2. Cryptorank – The one-stop shop for rankings

Cryptorank stands out with its comprehensive coverage of token rankings, IDOs, and fundraising.

Its killer feature ? Fundraising analytics—it shows which projects are raising capital, who’s investing, and how markets respond.

3. Messari – Deep dives into crypto projects

Messari offers institutional-grade research, data, and analytics.

Its killer feature ?

The ability to access detailed project profiles and quarterly free reports—ideal for informed decision-making and keeping tabs on industry trends. Below, for example, you can read the Q4 2024 detailed report on Tron.

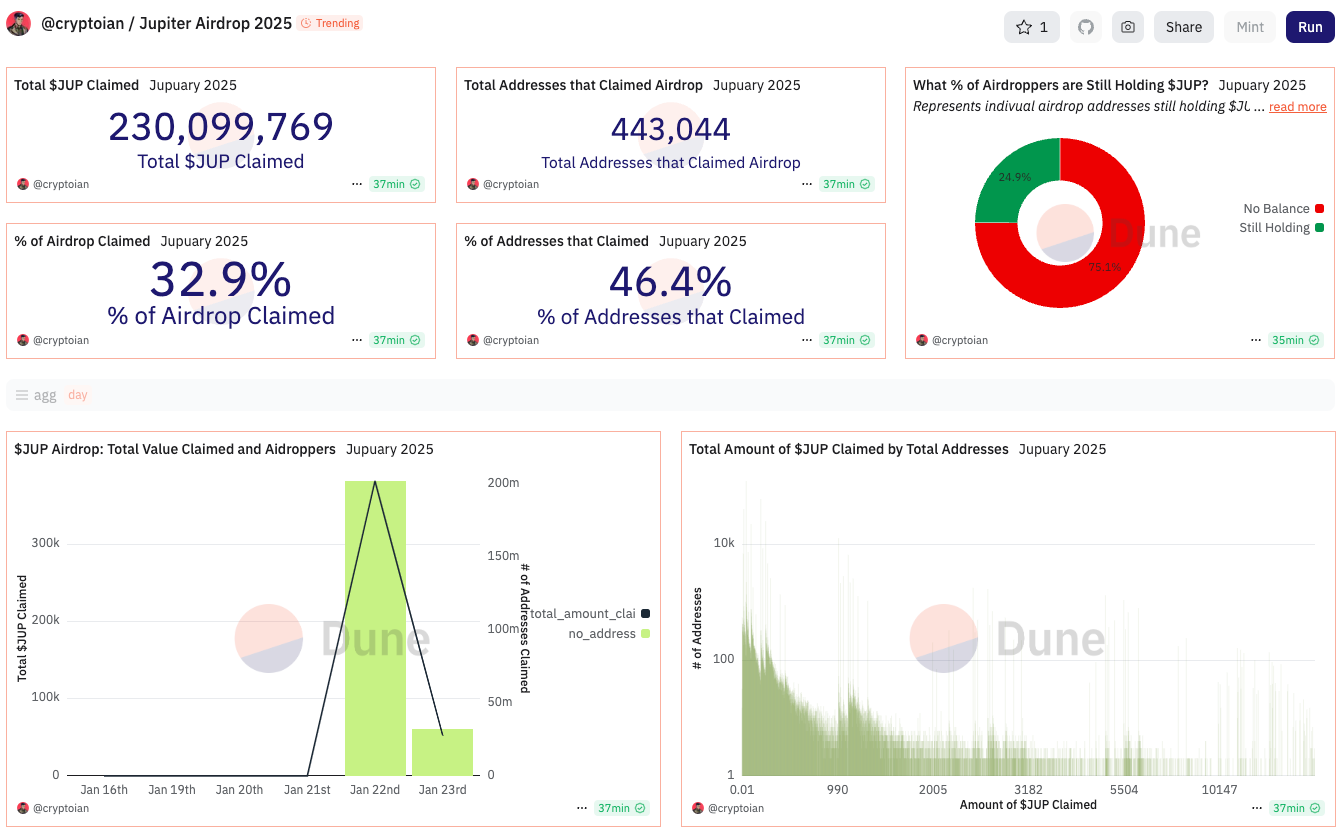

4. Dune Analytics – Custom dashboards for data nerds

Dune empowers users to build and share custom dashboards using on-chain data.

Its killer feature ?

Open access to community-built dashboards—you can analyze DeFi, NFTs, or specific projects with pre-built insights.

5. BubbleMaps – Visualize token movements

Bubblemaps creates visual representations of token distributions.

Its killer feature ?

Interactive “bubble maps” that highlight connections between wallets—great for spotting whale activity or identifying potential risks.

Also, we recommend to follow their X account where the team share great analysis on token distribution trendy projects. Example below for the $MELANIA memecoin 👇

6. Token Terminal – The financial lens on Web3

Token Terminal translates on-chain data into financial metrics, like P/E ratios and revenue.

Its killer feature ?

Traditional financial modeling tools applied to crypto—essential for comparing Web3 projects with legacy industries.

What’s your favorite tool on this list ? Did we miss any game-changers?

How to build an operating plan for your web3 startup

Building an operating plan may not sound glamorous, but it's one of the most effective ways to keep your Web3 startup on track. Emily Westerhold, a Partner at a16z Crypto, recently shared practical tips on how founders and CFOs can create plans that are simple, actionable, and adaptable.

Here’s how to get started:

1. Keep it simple

At its core, an operating plan answers four key questions: Who’s doing what? By when? At what cost? And how do we measure success? According to Emily, “It’s not about being overly academic. The goal is clarity and focus, not perfection.”

2. Don’t overestimate what’s possible

One of the biggest mistakes startups make is being overly optimistic about timelines and budgets. “Everything takes longer than you think,” Emily advises. Build flexibility into your plan, especially for critical milestones like hiring or launching a product. If one part of the plan slips, adjust the rest accordingly.

3. Sequence your priorities

Focus on doing the most impactful things first. For example, launching a key feature or securing early partnerships might unlock resources or opportunities to tackle the next big initiative. As Emily puts it, “You can’t do everything at once—trade-offs are healthy and necessary.”

4. Prepare for uncertainty

In the volatile Web3 space, scenario planning is non-negotiable. Build your budget with confidence intervals and consider different “what-if” scenarios, such as regulatory changes or market downturns. “Any budget you build will be wrong,” Emily says. “What matters is being prepared for a range of outcomes.”

5. Watch your cash runway

Maintaining at least six months of runway is essential. Falling below this threshold forces you to prioritize emergency fundraising or cost-cutting, often at the expense of growth. “You don’t want to spend most of your mental energy figuring out how to extend runway. Stay ahead of it.”

6. Measure what matters

Focus your metrics on outcomes, not just activity. For example, instead of tracking hours worked, measure progress on deliverables or user adoption. Align these metrics with your goals to ensure your team is working on the right things.

7. Budget from scratch

Rather than rolling over last year’s expenses, try zero-based budgeting: start from zero and justify every expense. This forces your team to think critically about what’s truly necessary.

Final thoughts

Operating plans aren’t just for keeping track of what’s happening—they’re a tool for creating alignment, spotting risks early, and staying focused on your goals. As Emily says, “You can’t control everything in a startup, but you can control how you plan.”

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.