🧙♂️ Tether’s tiny team, huge profits : what’s the Magic ?

And Dubai’s crypto dream: 5 realities you need to know before launching 🚧

Today's Agenda...

Discover the 5 game-changing secrets behind Tether’s success and boost your own business strategy! 💼🚀

Discover the hidden challenges of launching your crypto project in Dubai and make an informed decision! 🌍🚨

⏰ Reading Time: 7 min

Join the Web3 Leaders Community

The 5 secrets behind Tether’s success — What can you learn for your business ? 💡

Tether, the issuer of USDT stable coin, continues to break records with $1.3 billion in profits as of 30 June 2024, all while operating with fewer than 50 employees. How does a company this lean manage to outperform giants in both the traditional and web3 finance sectors? Let’s break down five key secrets behind Tether’s success, and what Web3 leaders can learn from it.

1. Focus on core competency 🎯

Tether is laser-focused on its core product: stable coins and of course the dominant USDT. By not diversifying too quickly or spreading resources thin across various products, Tether has been able to dominate the stablecoin market with USDT.

Nevertheless, this doesn't mean that the company is resting on its laurels, and you only have to look at the careers page to realize that AI seems to be at the heart of the company's current thinking: 10 AI job vacancies to be filled at the moment.

In a recent interview for The Block, Paolo Ardoino tells a bit more about AI strategy.

Link to the 9-minute clip on The Block's video podcast.

2. Monetizing liquidity 💵

Tether’s profits come largely from earning interest on its massive reserves. While Tether’s huge reserves lead to colossal interest earnings, it’s important to note that even with smaller treasuries, strategic placements can support operational costs in your project. The rise of DeFi offers various opportunities for making liquidity work effectively. Here is an example with yield offered on USDT :

3. Lean, specialized teams 🏋️

With the immense resources at its disposal, Tether could have easily gone in all directions—hiring rapidly, launching a multitude of products, and expanding into various sectors. Yet, despite its financial power, Tether remained disciplined. Instead of scaling up recklessly, it focused on maintaining a lean team of fewer than 50 highly specialized employees, optimizing its core business and ensuring maximum efficiency.

The next time you’re tempted to expand your team impulsively, think of Tether. You can explore the composition of Tether’s team on LinkedIn here.

4. Resilience and stress-testing 🧠

Tether’s resilience was put to the ultimate test during two significant market shocks: the collapse of UST and the subsequent downfall of FTX. Unlike many others in the industry, Tether weathered these crises, maintaining stability and confidence. These events didn’t just demonstrate Tether’s strength, they also raised important questions about readiness and survival.

Has your company faced moments of intense pressure like this ? What lessons did you learn from them ? If a similar situation occurred again, would you be prepared ?

5. Passion for the mission 🔥

One of the driving forces behind Tether’s success is the passion of its CEO. Paolo Ardoino’s dedication to his work reflects a deep commitment to his mission, similar to how Steve Jobs spoke about the importance of passion in overcoming entrepreneurial challenges.

As Ardoino mentioned in a CoinDesk interview:

“I don’t have other passions apart from what I am doing,” he said.

Steve Jobs also emphasized that passion is often the only thing that can drive an entrepreneur through the difficulties of building a business over many years :

What’s Your Next Move? 🚀

Now that you’ve seen what makes Tether successful, it’s time to reflect.

What’s one concrete step you can take this week to strengthen your own project ?

Top 5 reasons not to choose Dubai when building a crypto project

As of 2023, there are more than 1,800 organizations operating in the Web3 space within the UAE. This shows rapid growth and a strong focus on developing the digital economy, with significant initiatives in both Dubai and Abu Dhabi.

So it can be a good choice to go there. However, some projects are a bit disappointed when they discover the reality of this place. That’s why we will specifically focus on the cons here ; you can easily find the pros elsewhere on the web. Feel free to share your own experience in the comments.

Here are the top 5 reasons why an entrepreneur might hesitate to choose Dubai as a base for developing a crypto project:

1. Evolving regulation

Issue: You expect less regulation in Dubai ? While Dubai has taken steps to become a crypto hub, the regulatory framework is still developing. This means that the laws could change quickly, creating uncertainty for businesses. Rules around ICOs, tokens, and crypto exchanges may continue to evolve, and sudden policy changes could impact operations. The regulation is similar as other places like European Union.

Consequence: You may have to constantly adapt your legal and operational structure to comply with new regulations, leading to additional costs and instability.

Visit the VARA (Dubai regulatory authority) website to check rules for your business :

2. Increase of taxes and complexity

Issue: Dubai needs revenue and is progressively introducing taxes. VAT and corporate taxes are the first to be implemented, and we can assume that new taxes are on the way. While they will remain competitive to attract projects, businesses need to understand that complexity is increasing at the same time. There is a significant lack of qualified chartered accountants to handle tax declarations and provide visibility on what to expect in terms of taxation by the end of the year. This type of declaration is relatively new for them to manage. At the same time, their services are expensive, even though much of their work is outsourced to Pakistan or India.

Consequence: Don’t come to Dubai for simplicity.

3. High cost of living and business operations

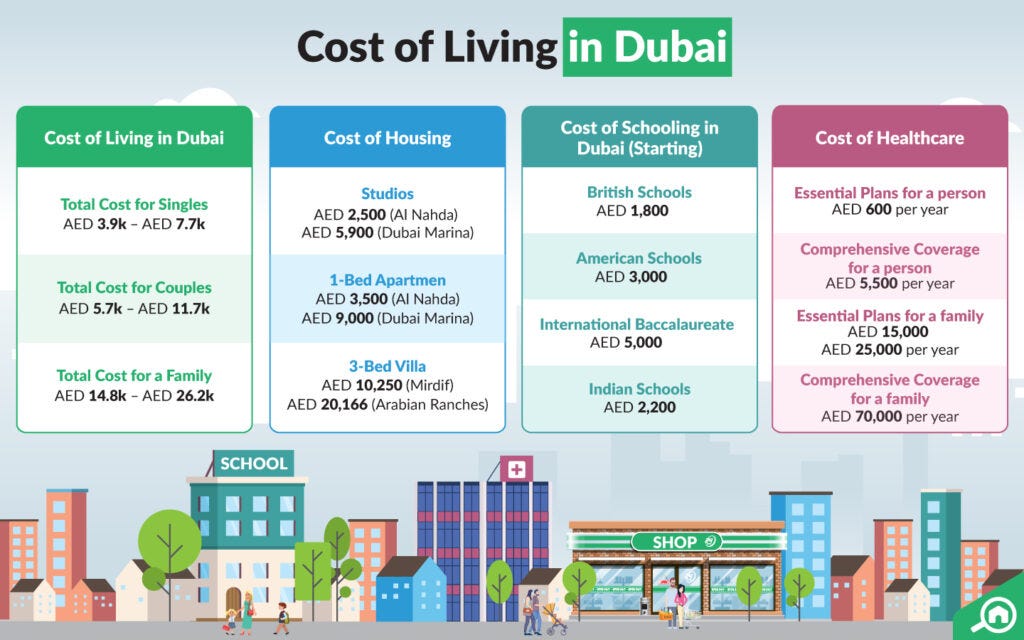

Issue: Dubai is an expensive city to live and do business in. Office rents, professional services (lawyers, consultants), and even the cost of living for expatriate employees can be high.

Consequence: These costs can heavily strain the budget of a startup in its development phase. You may end up spending a large portion of your resources on operational expenses rather than product development or user acquisition.

Image source : www.bayut.com For information, the AED/USD exchange rate was 0.27 on September 24, 2024.

4. Lack of localized talents

Issue: Although Dubai attracts international talent, it doesn’t yet have the same pool of blockchain developers and cryptocurrency experts as hubs like San Francisco, Singapore, or Paris. The local market for Web3 specialists remains relatively limited.

Consequence: Finding qualified developers, blockchain security experts, or even product managers familiar with crypto models can be difficult and expensive if you need to attract foreign talent with competitive compensation packages.

5. International perception and reputation

Issue: Despite Dubai’s advances in the crypto space, it is sometimes perceived by investors or certain international stakeholders as a jurisdiction where regulations are not always aligned with Western transparency and compliance standards. This could also become an issue if international regulations evolve unfavorably towards jurisdictions deemed more “lax.”

Consequence: This may affect your project’s credibility with certain institutional investors or potential partners, who might prefer jurisdictions with a stronger reputation for regulation and investor protection.

These reasons do not necessarily mean that Dubai can’t be a good choice for some crypto businesses, but they highlight important factors to consider when deciding whether to establish a project there.

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.