This summer, we're taking a break and we bring you the best articles from the past year. Each week, enjoy a top pick that has resonated most with our readers. Perfect for a fresh read or a timely revisit. ✨

Thank you again for your confidence in us.

There are now more than 1 000 of you following us every week. 🙏

How much does it cost to list your token ?

Originally published on 28 February 2024

We are witnessing an intensification of listings among our clients, which are linked to the better shape of the crypto markets. 📈 This is an opportunity to revisit some key points to properly understand this type of operation from an 'internal' perspective.

Let's look at the main cost centers. However, beware, these depend heavily on market conditions and the balance of power between the exchange and you :

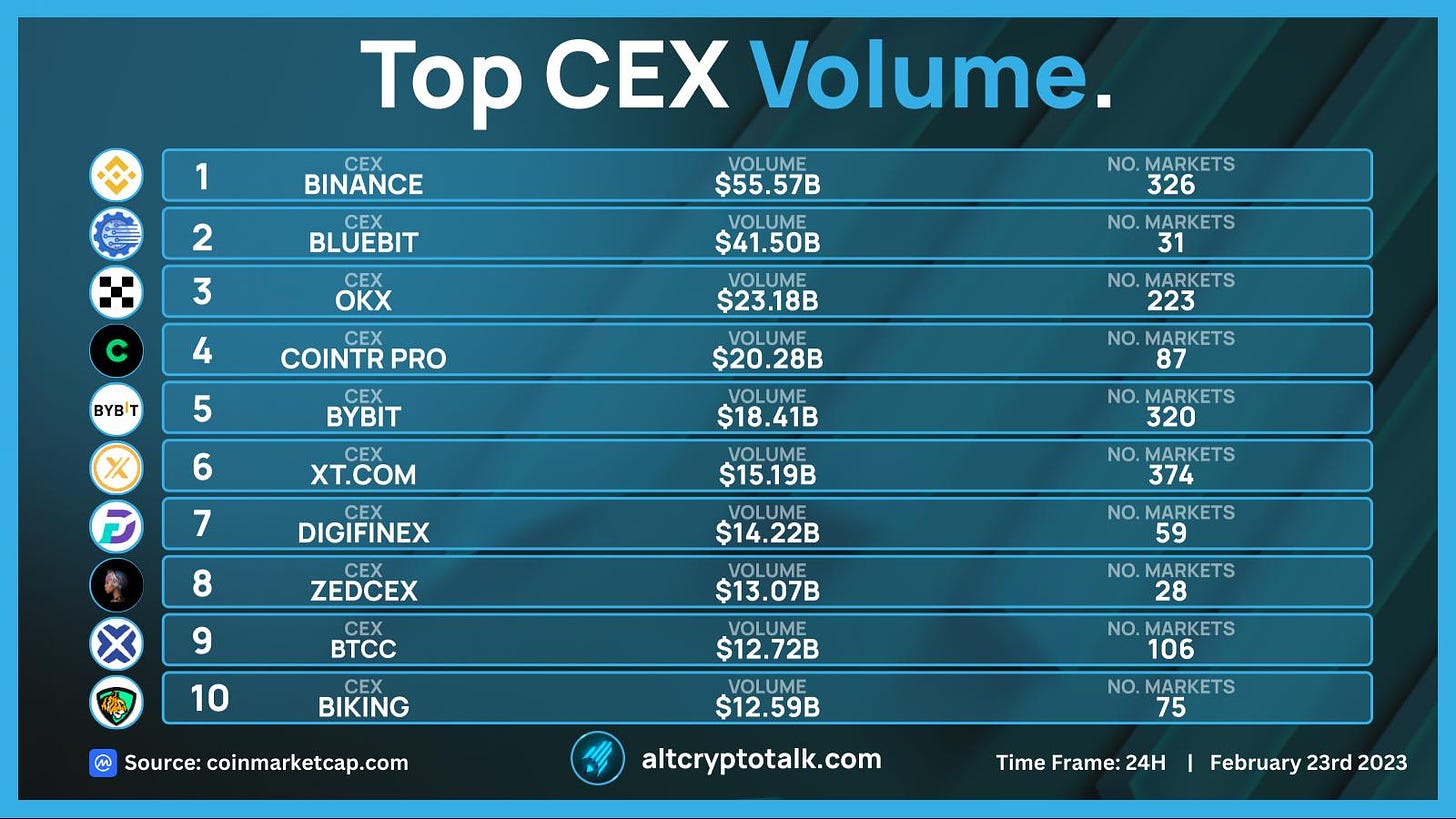

Listing fees: Some platforms charge submission fees to review your project and listing fees to include your token on their platform. These fees can range from a few thousand to several hundred thousand dollars. 💸

Marketing services: To ensure the success of the listing, the exchange and the project set their commitments in terms of marketing. Sometimes the exchange will require the project to use its own marketing services. In any case, launching a listing without the associated marketing effort will make it difficult to find a ROI on the operation. You should count at least several tens of thousands of USD. 📢

Updating your compliance papers: The legal documentation requested by exchanges to guarantee the legality of your operations is important, and you will probably be asked for a legal opinion written by a law firm for a few thousand USD. The good news is that you can reuse it for future listings. 😊

Security deposit: The security deposit generally serves to protect the exchange platform against risks associated with the listing of a new token. It acts as a form of insurance, covering potential losses or costs that could arise in case of problems with the token, such as security breaches, fraud, or non-compliance with regulations. Here too, it's on a case-by-case basis and will depend particularly on the amount of the listing fees. The terms of recovery of the deposit also vary a lot. 🔒

Market Making fees and dedicated treasury: The exchange will require you to ensure liquidity on its platform via a market maker with a strict specifications based on feeding the order books. The market maker, if operating as a service provider, will charge you about 5000 USD per month to trade a pair on an exchange. However, it will feed the order books with the treasury you will entrust to it: it is generally difficult to work with less than 100k USD in the native token of the project + 100k USD of the token against which it is exchanged (often a stablecoin). 📊

The whole calculation is now to assess whether the impact on the price of the token will make your investment profitable. However, it's crucial not to overlook the significance of the extra liquidity that can be leveraged to enable the project to amplify its liquidation volume, all the while ensuring it stays within boundaries that safeguard the community's interests. 📈💧

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.