🌊 Is it time to ride the restaking wave?

And the ultimate hack for recruiting blockchain devs 🎣

Today's Agenda...

Restaking: a powerful way to boost user engagement and token utility in DeFi, but not without risks ⚡🔐.

Find top blockchain devs by tracking their real contributions and connecting with them directly 🚀🛠️

⏰ Reading Time: 5 min

Join the Web3 Leaders Community

Should web3 project creators integrate restaking ? Pros and cons

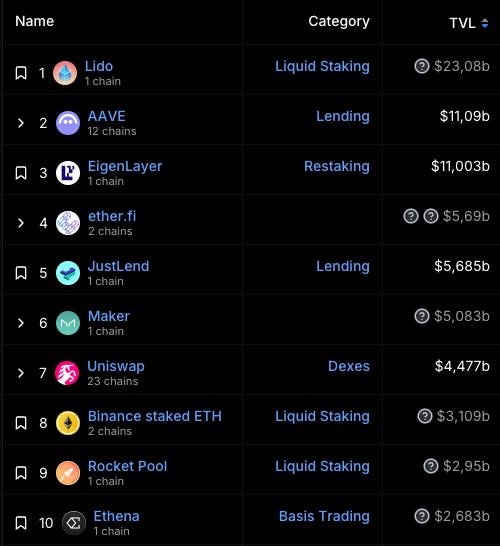

Restaking has emerged as one of the most significant narratives. This mechanism, which allows users to stake already staked assets across multiple layers or protocols, is gaining traction. The rise of protocols like EigenLayer and ether.fi —both now in the top 10 DeFi projects, according to DeFiLlama—shows just how impactful this trend has become :

But should you integrate restaking into your project ? Here’s an overview of the key advantages and limitations to help you decide.

Why should you consider restaking for your project?

Increased user engagement and retention: integrating restaking into your Web3 project can attract users who are looking for ways to maximize their yields. By offering restaking opportunities, you're providing more incentives for users to keep their assets on your platform, fostering longer-term engagement and reducing the likelihood of users moving their assets to competitors.

Improved token utility: restaking adds layers of utility to your native tokens. Instead of having a token solely used for staking on your platform, users can utilize it across other protocols, increasing the value proposition of holding and staking your token. This added utility makes your project more attractive to users who want to get the most out of their holdings.

Enhanced network security: restaking can help increase the security of your network by encouraging more staking, as users see an added benefit to locking up their tokens. A higher percentage of staked tokens translates to a more secure and decentralized network, making it harder for bad actors to launch attacks.

Interoperability and ecosystem growth: by supporting restaking, your project becomes part of a broader ecosystem, facilitating cross-protocol interaction. This can lead to strategic partnerships with other Web3 platforms and projects. Supporting restaking enhances the interoperability of your project within the Web3 space, promoting a more integrated ecosystem that benefits everyone.

What are the drawbacks of restaking for your project?

Added complexity for users: while restaking can be an appealing feature, it adds a layer of complexity for users who might already be unfamiliar with the basics of staking. Not all users are comfortable navigating the intricacies of managing assets across multiple protocols, and this added complexity can alienate newcomers or lead to user errors.

Higher risk of slashing: restaking can expose users to higher risks of slashing, where staked assets are penalized for validator misbehavior or network downtime. When users restake their tokens across multiple platforms, any failure on one layer could result in a loss of assets, which can be a disincentive for users and result in a negative experience.

Liquidity fragmentation: restaking could lead to liquidity fragmentation, where the same assets are locked into several different layers or protocols, limiting their accessibility. While liquid staking derivatives can provide users with more liquidity, it may still introduce challenges in liquidity management, both for your project and the broader ecosystem.

Governance and security concerns: allowing tokens to be restaked across multiple protocols could dilute the governance power of your network, as users might be incentivized to participate more actively in governance on other platforms. This could weaken your project's decision-making processes and introduce risks if governance power shifts to competing platforms.

Additionally, if the restaked assets secure other networks or protocols, the security implications need to be carefully considered. Any vulnerabilities or failures in the restaking process could impact your project's overall security.

Conclusion: should you implement restaking?

Restaking offers exciting opportunities for increased user engagement, enhanced security, and ecosystem growth. However, it also introduces complexities like higher risks of slashing and liquidity fragmentation.

Projects with DeFi-savvy users and strong staking infrastructure are best suited for restaking. If your audience is newer to staking, focus on user education and implement safeguards to manage potential risks.

The ultimate hack for recruiting blockchain devs 🚀

Finding top-tier blockchain developers can be like searching for a needle in a haystack. With demand soaring and talent scattered across the globe, recruiters need every edge they can get. Enter Reputable—the leaderboard that ranks blockchain developers based on their contributions, reputation, and expertise. It's a goldmine for anyone looking to hire the best in Web3. At the time of writing, 1,119 developers were registered on the platform.

You can filter by 23 types of expertise labels, for example :

Reputable gives a clear picture of which devs are at the top of their game. Whether you're looking for a Solidity expert or someone who has crushed it on Ethereum, this platform lets you filter devs by protocol and specializations. But here’s where things get really interesting : these profiles are connected to GitHub.

As a recruiter, this is your secret weapon. Most GitHub profiles include precise contact details—email, personal pages, even social media links like Twitter. And with just a free GitHub account, you have instant access to this valuable information.

So, rather than sifting through resumes, you can dive directly into their contributions and reach out to those making the biggest impact. It’s like peeking behind the curtain of the entire blockchain dev community and hand-picking your next hire.

No need to wait. Get on Reputable, identify your ideal candidate, and make your move. The best devs are just a GitHub message away. 🔥

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.