💵 How to deal with FIAT payments when banks hate you ?

And quick recruitment : be ready for the Bull Run ♉️

Today's Agenda...

Web3 projects struggle with FIAT payments due to banks' reluctance, but alternatives like Nilos or Payhawk offer solutions.

Accelerate web3 hiring during the bull run ! Instant talent access, specialized recruiters, agile processes for success.

⏰ Reading Time: 5 min

Join the Web3 Leaders Community

How to deal with FIAT payments ?

While the growth of DeFi and the increasingly common acceptance of stablecoins allow web3 projects to expand, it remains very challenging to completely break away from the traditional banking system. Indeed, paying rent and electricity bills in crypto is not (yet) a common practice... Yet, banks are far from welcoming web3 initiatives with open arms. 🏦

Why do banks regularly refuse web3 projects?

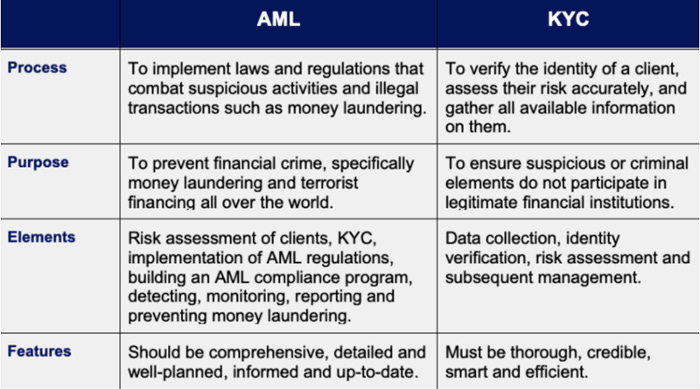

Banks are subject to stringent requirements regarding the origin of the funds they accept, especially to comply with Anti Money Laundering (AML) and terrorism financing regulations.

A lack of understanding of blockchain operations might lead them to believe that complying with these obligations is not feasible. While some banks recognize that it's possible to ensure perfect regulatory compliance, they often do not want to train their teams and develop adequate control procedures due to costs: as long as the web3 client is marginal, it's cheaper for the bank to lose them rather than overhaul their control processes. 💼

Which institutions will accept them?

Generally, you should target institutions for which the "niche" of web3 clients is significant enough that they want to delve into your KYC and AML processes and then accept you as a client. This is often the case with small local banks or neo-banks. However, be cautious with the latter, as it's not uncommon for them to frequently revise their policies once they've achieved their growth objectives.

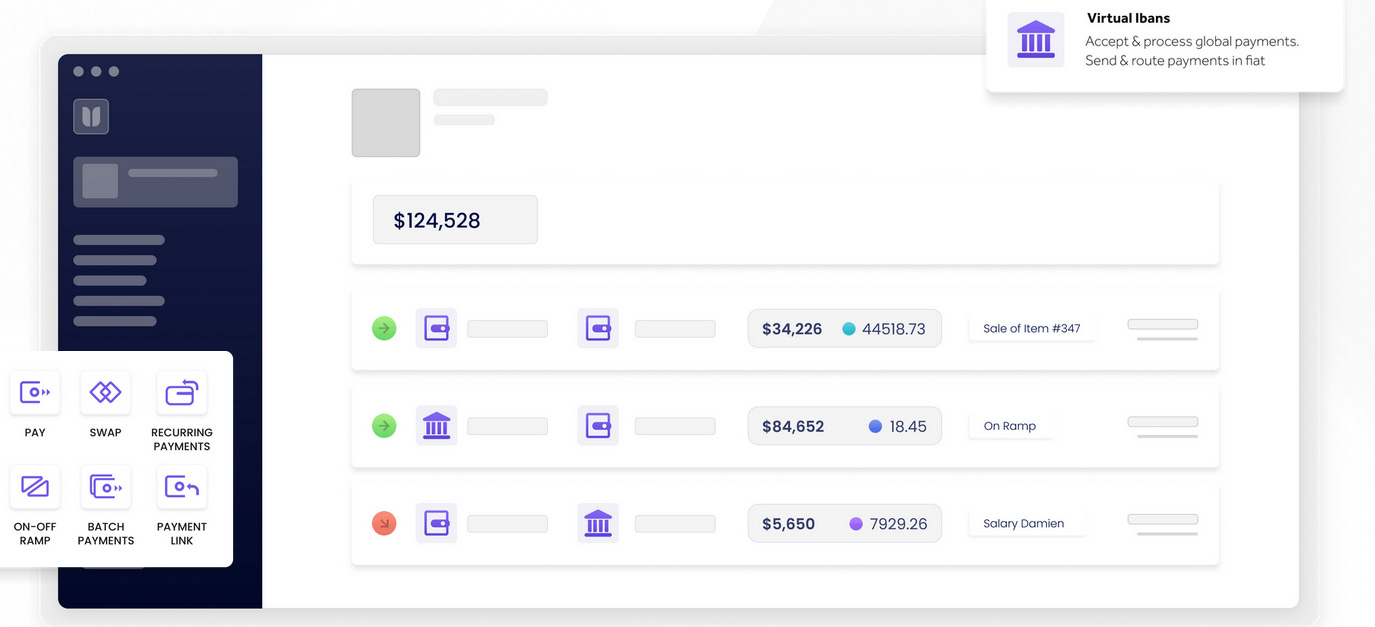

Some startups today specialize in web3 to offer banking solutions that are both pro-business and compliant with regulatory requirements. For example, Nilos combines wallets and a bank account in a single interface, allowing you to make frictionless transfers between them. 🌐

What are the alternatives?

Some projects create ad hoc entities like Special Purpose Vehicule (SPV) that accommodate the non-crypto part of their activities (e.g., consulting or software development for third parties) to easily obtain a bank account.

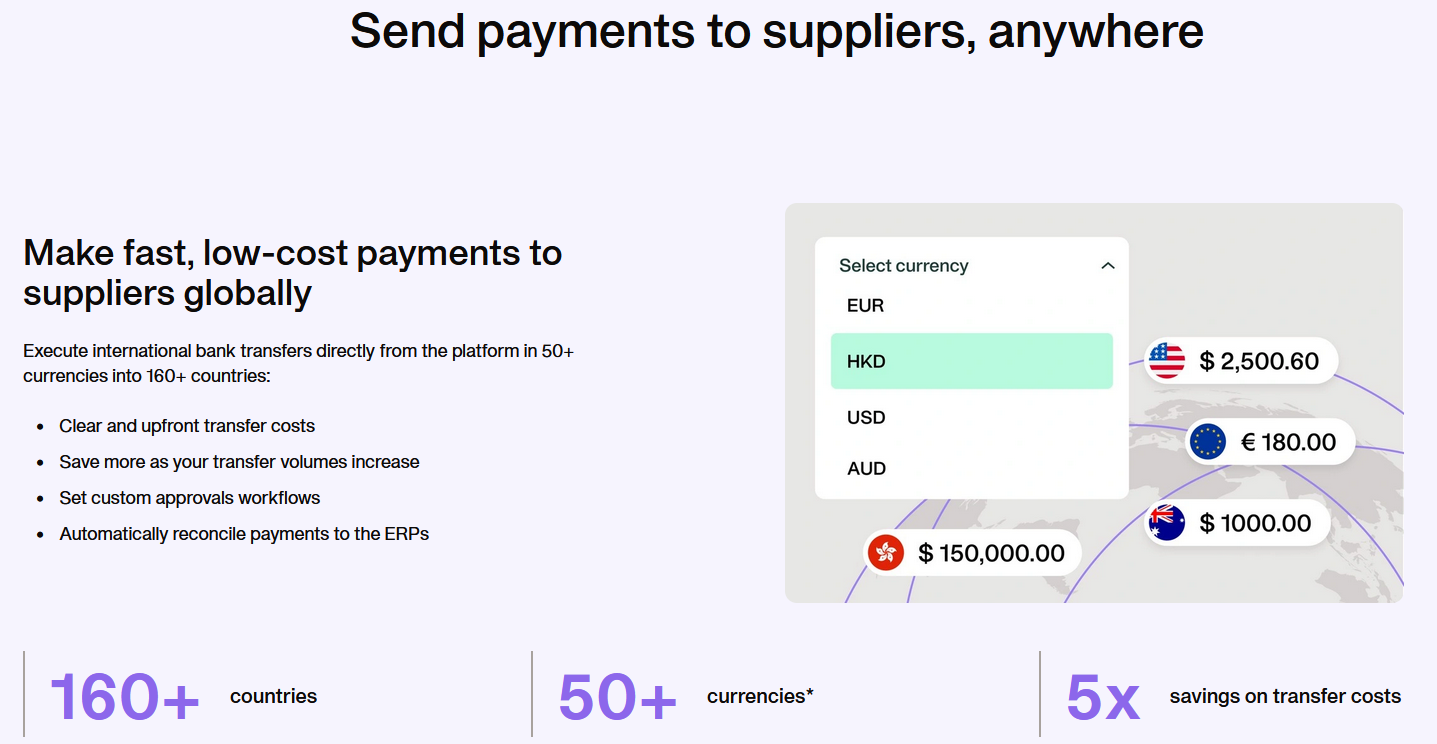

Others use supplier payment management solutions (like Spendesk, Payhawk) that may allow, after discussions with their compliance teams, the acceptance of funds from exchanges to pay suppliers via bank transfers or credit cards.

Conclusion

If you're in a position to explain the origin of your funds and your compliance processes, you'll undoubtedly find a partner to support you. If not, a solution like Nilos, Spendesk or Payhawk could be salutary.

♉️ Quick Recruitment : be ready for the Bull Run

Seizing opportunities during the bull run demands agility in assembling top-notch contributors. This article delves into the urgency of reducing recruitment times and proposes a few options for swift and effective team building.

1. Bull Run Urgency ⏰

As the bull run gains momentum, time becomes a critical factor for web3 projects. Traditional recruitment processes can be sluggish, causing missed opportunities in the rapidly changing market.

According to HackerRank's survey of 5,297 tech hiring stakeholders, the average time-to-hire (from job opening to offer letter) is 29 days in companies with fewer than 1,000 employees. Imagine that you have to add the notice period, which generally ranges from 1 to 3 months. It can go from 2 to 4 months minimum to finally have someone join the company. We wrote "join", not "be fully productive"😅

2. Instant Access to Talent 🌐

Freelance platforms like Upwork, Fiverr, Freelancer.com , Toptal or Malt offer instant access to a global talent pool, enabling businesses to swiftly onboard contributors with specialized skills essential for maximizing impact during the period that allows any project to move to the next level: the bull run.

Web3 projects must adapt quickly to market trends. Freelancers, accustomed to diverse projects, bring a nimbleness that is vital for riding the highs and adjusting strategies as needed.

Read our full analysis on “Contracting in the Web3 World” in a previous edition here.

Harnessing Specialized Talent Hunters on those platforms: 🔍

To expedite the recruitment process further, consider engaging a specialized recruiter familiar with the intricacies of freelance platforms. A skilled talent hunter swiftly identifies the top talents aligned with your project's needs, presenting you with a refined selection for testing. This approach enhances the efficiency of your recruitment strategy, ensuring you quickly assemble a team primed for success.🚀🌐

Breaking the Mold 🔄

For these specialized profiles, it's crucial to break away from traditional recruitment patterns. Avoid replicating lengthy interview processes ; instead, focus on conducting one or two maximum interviews. The emphasis should be on rapid testing through paid tasks. In the web3, practical skills often speak louder than traditional qualifications. By swiftly immersing candidates in real-world tasks, you gain valuable insights into their capabilities, ensuring a more accurate and efficient selection process. 🚀💡Don't forget that the best freelancers often refuse unpaid tests (and I can understand that) !

Conclusion

While the freelance model offers unparalleled flexibility and speed in web3 projects, it's not a one-size-fits-all solution. Striking the right balance between freelancers and traditional employees is crucial for long-term success. Embrace the agility of freelancers while acknowledging the stability and commitment traditional employees bring to the table.

To find out more, we also wrote on the same topic :

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.