🕵️ Forget LinkedIn ! Discover the secret sites for top web3 hires

And 5 Tips to review your crypto accounting 🧾

Today's agenda...

Beyond LinkedIn: discover web3’s hidden talent on niche platforms like Degenscore, Talent Protocol and Reputable. 💎🌐

From transaction tracking to tax implications, a guide to a smooth year-end accounting review for crypto projects. 🧾✨

⏰ Reading time : 7 min

Join the Web3 Leaders Community

Beyond LinkedIn : unearthing web3 talent in hidden corners 🌐✨

Finding the right talent takes more than just scrolling through LinkedIn or browsing freelance sites. Instead, recruiters must dive into niche communities and leverage tools tailored for this emerging industry. Here are three standout platforms to help you tap into Web3's hidden talent pools. 💎🔍

1. Degenscore : decoding DeFi to find top Talent 🏦👾

Degenscore bridges decentralized finance (DeFi) with talent scouting. The platform assesses user activity within the DeFi space, offering a unique metric for spotting high-caliber, on-chain-active candidates.

Users can mint a Beacon profile—a SoulBound Token (SBT)—where their DeFi involvement is scored based on their on-chain actions. The higher their score, the greater their access to exclusive opportunities like early access to projects and airdrops.

For employers, Degenscore allows job postings tailored to this knowledgeable audience. Simply include a field for candidates to share their Beacon profile to reach some of the most engaged DeFi enthusiasts. According to Degenscore, “The DegenScore Beacon holders are the most active and skilled on-chain users across crypto and control over $400m just on Ethereum.” 😱

You can contact Degenscore here.

2. Talent Protocol: empowering builders with purpose 🌐💼

Talent Protocol's mission is to support Web3 builders on their professional journeys bringing them professional onchain reputation. The most active builders gain visibility and access to unique opportunities.

Talent Protocol is a powerful but selective talent pool where each individual is committed to Web3. As a recruiter, connecting with talent here is straightforward—set up a free account and reach out directly through the in-app messaging system.

You can have a look at their Talent API pricing here.

3. Reputable: your secret weapon for finding top blockchain Devs 🚀

Locating skilled blockchain developers can feel like searching for a needle in a haystack, especially with talent dispersed across the globe. Reputable ranks developers based on their contributions, reputation, and areas of expertise, making it a powerful tool for recruiters.

With over 1,100 developers registered, Reputable enables you to filter by 23 different areas of expertise, such as DeFi, DEX, RWA, etc, and dive into candidates’ GitHub-linked profiles. This allows you to verify their actual contributions, while also gaining direct access to contact information such as emails, personal websites, and/or social media links like Twitter.

Stop sifting through CVs—start by identifying the top performers on Reputable and reaching out. Your next star developer could be just a GitHub message away. 🔥

Bonus : insights from Kiln's COO on effective Web3 recruitment

In the Behind The Chain podcast, Romain had the opportunity to interview Thomas de Phuoc, COO of Kiln, a few months ago. Thomas has showcased exceptional adaptability and strategic thinking as COO and co-founder of Kiln. His approach to operations in the Web3 space offers valuable takeaways for scaling recruitment in a web3 startup :

Clear Recruitment Needs: He insists on the clarity of the recruitment need before initiating the hiring process, ensuring that every new addition addresses a concrete requirement within the team.

Consistent Recruitment Process: Thomas ensures that each candidate undergoes the same rigorous recruitment process, maintaining fairness and consistency, and allowing for accurate assessment and comparison of candidates.

Internal Talent Acquisition: For recurring roles within the company, Thomas leverages his internal talent acquisition team, optimizing their understanding of Kiln's culture and needs.

External Headhunters for Executive Roles: For specialized or seldom-recruited roles, such as executive positions, Thomas finds value in engaging external headhunters. This approach taps into their vast network and expertise, ensuring the recruitment of top-tier talent suited for Kiln's high-stakes environment.

5 Tips to review your crypto accounting: lessons from the field

As the end of the year approaches, it’s officially time for crypto projects to organize their annual accounting review. For many new projects, this first-time crypto accounting exercise can be daunting—especially with the unique tracking, valuation, and tax challenges involved. Based on our own lessons from the field, here are some real-world tips to make this year-end review process smoother and more accurate.

1. Track every transaction – the devil’s in the details

When you’re reviewing your year’s transactions, you may realize just how easy it is to lose track of a few along the way. Without a clear system in place, even the smallest transactions can go unnoticed—especially if your assets are spread across multiple wallets or exchanges. Our best advice : use dedicated crypto accounting software to keep transactions organized by timestamp and wallet address from day one, and make it a habit to reconcile monthly.

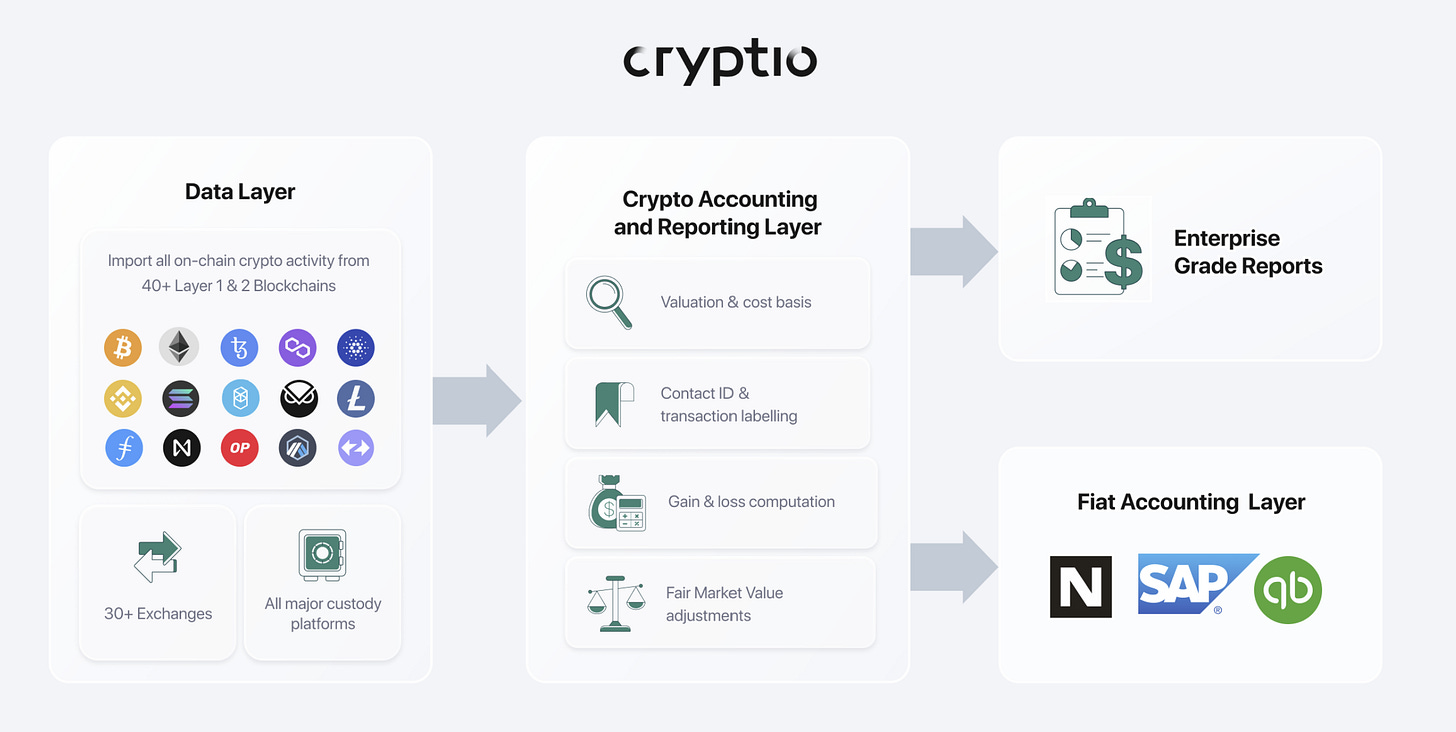

We like to use Cryptio (no affiliation or partnership).

At year’s end, you’ll thank yourself for maintaining a consistent system. A full year’s worth of transaction logs can be tedious to sort through, but keeping everything up to date avoids nasty surprises in the final audit.

2. Know the tax implications for every type of transaction

With tax season on the horizon, it’s essential to categorize each type of crypto transaction correctly. Early on, we learned how varied the tax treatments can be: capital gains for trades and sales, versus ordinary or financial income for staking rewards, airdrops, or mining. Sorting these out accurately before filing will save you headaches, avoid penalties, and ensure you don’t miss out on any potential deductions.

If you’re new to crypto accounting, bringing in a tax professional who understands the space is a smart move. The nuances are enough to justify the investment—they’ll catch potential misclassifications that could otherwise be costly.

3. Real-time valuation is essential

As the year wraps up, accurately valuing your crypto holdings is critical, especially since prices fluctuate constantly. At first, we thought end-of-day valuations were enough, but when we saw how quickly values changed, we knew we needed real-time data for accurate reporting. For your year-end financials, this precision will make a big difference, especially if you’re sharing reports with investors or preparing regulatory filings.

One trick: if you’re using a software tool that connects to a live price feed, set it to update frequently so your year-end reports reflect accurate valuations.

4. Don’t let fees and expenses fall through the cracks

Transaction fees like gas, network fees, and service charges can easily pile up over a year, and if they’re not accounted for properly, they can distort your financial statements. Early on, we missed categorizing these costs consistently, which led to inaccuracies in our profit margins. Our solution ? Allocate time each month to review and categorize these expenses. For the year-end review, go over all fees carefully to ensure that none have slipped through the cracks.

Doing this on a regular basis keeps your year-end financials clean and saves a ton of time and hassle.

5. Regular reconciliations are non-negotiable

If you’re doing this review at year-end for the first time, reconciliations might feel overwhelming, but they’re a must. Without regular checks, even minor errors can turn into big problems. A monthly or quarterly review cycle, depending on your volume of transactions, will help catch discrepancies before they become issues. For this final year-end reconciliation, make sure everything aligns with the blockchain data.

If possible, an external auditor’s review can add extra assurance. It might seem like an added expense, but an external audit is often worth it for the peace of mind and added credibility it brings.

Final thoughts

Year-end is the perfect time to reflect on your crypto accounting processes, adjust, and improve. Tackling these tasks—tracking transactions, understanding tax treatments, ensuring real-time valuations, categorizing fees, and conducting reconciliations—will make a big difference as you move forward. By getting this right now, you’re setting yourself up for a smoother, more successful next year in the crypto world.

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.