Today's Agenda...

A solution for enhanced web3 collaboration amidst multitasking, remote work, and decentralized recognition. 🚀🤝

Listing your token involves hidden costs such as fees, marketing, compliance papers, security deposit, and market making. 💸📊

⏰ Reading Time: 6 min

Join the Web3 Leaders Community

How to heavily commit contributors to your web3 project ?

Engage decentralized teams poses unique challenges. Here's why :

Multitasking contributors 🤹♂️: Many contributors are engaged in multiple projects or DAOs concurrently. In this environment, encouraging them to prioritize a specific project becomes a constant challenge.

Remote and asynchronous work 🌐: The remote and asynchronous nature of web3 work makes it difficult to foster a strong sense of belonging and camaraderie among team members. Building relationships and meaningful connections between colleagues becomes a puzzle.

Recognition in a decentralized structure 🏛️: The absence of a traditional hierarchical structure can sometimes lead to a perceived lack of recognition. Contributors may feel their efforts go unnoticed in the absence of a clear system to acknowledge and reward their contributions.

How can you tackle these issues and build a thriving collaborative environment ?

Coordinape could be your saviour 🚀🤝

Coordinape is a truly next-level collaborative solution. It isn't just for decentralized autonomous organizations (DAOs) ; it's for any decentralized team – because let's face it, you can work in a decentralized way without being a DAO ! :)

Coordinape facilitates collaboration and the fair distribution of value within a circle of contributors.

For the organization using this tool, it becomes a means to allow contributors to express gratitude and credibility towards other members in a given work circle.

How does it work in practice ?

Here are the simplified steps:

A circle of contributors is allocated a budget in USDC, for instance. 💰

Each contributor receives a certain amount of GIVE tokens, which they can then redistribute to other circle members to acknowledge their contribution by providing public feedback. 🔄

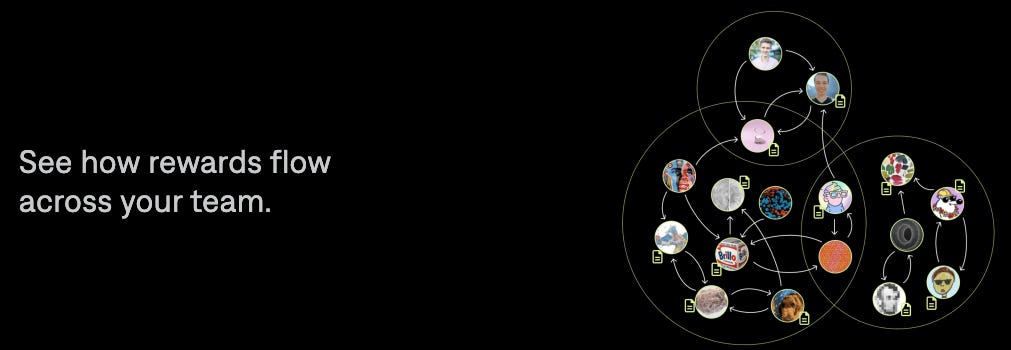

Image Credit : Coordinape website At the end of the work period (EPOCH), each contributor receives an amount of USDC equivalent to the GIVE share they hold in the circle. 💸

For example, if Paul holds 20% of the GIVE in the circle and the budget was 10K USDC, he then receives 2,000 USDC. 💼

Interesting feature: you can view the reward flows between all your contributors. This can help you identify dysfunctional working relationships between certain circles or certain contributors within the same circle.🌐

The application also allows for generating additional fixed payments. 🚀

Why does the vision of this tool resonate strongly with the Chain Reaction team ?

Because…

It empowers contributors to assess the co-created value responsibly. 🌱

It provides complete transparency in the value redistribution process. 🔍

It fosters a strong and cohesive working collective, potentially preventing managerial biases in performance analysis. 🤝

Of course, no tool is perfect, and we acknowledge that a risk of equitable distribution, rather than meritocratic, may tend to emerge in certain teams... ⚖️

Discover Mava

Mava is a customer support platform for community-driven companies. It enables you to support your community across multiple channels (your website, Discord, Telegram) from one powerful and secure dashboard.

Mava built an AI Bot to answer questions in public Discord channels, private Discord Tickets, web chat and Telegram, automatically. You only need to upload a link to your knowledge base to get started.

Trusted by hundreds of communities, such as Cosmos, Alchemy, 1inch & DeGods.

*commercial link

How much does it cost to list your token ?

We are witnessing an intensification of listings among our clients, which are linked to the better shape of the crypto markets. 📈 This is an opportunity to revisit some key points to properly understand this type of operation from an 'internal' perspective.

Let's look at the main cost centers. However, beware, these depend heavily on market conditions and the balance of power between the exchange and you :

Listing fees: Some platforms charge submission fees to review your project and listing fees to include your token on their platform. These fees can range from a few thousand to several hundred thousand dollars. 💸

Marketing services: To ensure the success of the listing, the exchange and the project set their commitments in terms of marketing. Sometimes the exchange will require the project to use its own marketing services. In any case, launching a listing without the associated marketing effort will make it difficult to find a ROI on the operation. You should count at least several tens of thousands of USD. 📢

Updating your compliance papers: The legal documentation requested by exchanges to guarantee the legality of your operations is important, and you will probably be asked for a legal opinion written by a law firm for a few thousand USD. The good news is that you can reuse it for future listings. 😊

Security deposit: The security deposit generally serves to protect the exchange platform against risks associated with the listing of a new token. It acts as a form of insurance, covering potential losses or costs that could arise in case of problems with the token, such as security breaches, fraud, or non-compliance with regulations. Here too, it's on a case-by-case basis and will depend particularly on the amount of the listing fees. The terms of recovery of the deposit also vary a lot. 🔒

Market Making fees and dedicated treasury: The exchange will require you to ensure liquidity on its platform via a market maker with a strict specifications based on feeding the order books. The market maker, if operating as a service provider, will charge you about 5000 USD per month to trade a pair on an exchange. However, it will feed the order books with the treasury you will entrust to it: it is generally difficult to work with less than 100k USD in the native token of the project + 100k USD of the token against which it is exchanged (often a stablecoin). 📊

The whole calculation is now to assess whether the impact on the price of the token will make your investment profitable. However, it's crucial not to overlook the significance of the extra liquidity that can be leveraged to enable the project to amplify its liquidation volume, all the while ensuring it stays within boundaries that safeguard the community's interests. 📈💧

If you come to Paris Blockchain Week, don’t hesitate to book a coffee slot with us by sending a message on our Telegram ☕.

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.