🚫 Avoid these 5 mistakes and win a grant for your web3 project !

And 2 major evolutions we observed recently 👀

Today's Agenda...

Avoid grant pitfalls: time it right, tailor, show traction, design well, communicate directly. 🚀🎁

2 trends : new power relations between web3 devs and projects + transparency requirements by communities👩🏽💻🔎

⏰ Reading Time: 7 min

Join the Web3 Leaders Community

5 mistakes not to make when applying for a grant ❌

(from discussions with 100+ web3 foundations)

The article below was written by Corentin Cadieu, founder and CEO of 0xlabs.

Now seems like the perfect time to apply for grant programs, with the return of the bull market, foundation budgets are booming, and the number of projects to apply for is small in comparison, with many projects unfortunately being dead during last bear market.

As entrepreneurs in the web3 ecosystem, we're lucky to be in a sector where there are many non-dilutive funding solutions : +200 active grant programs to be exact (for a total of 1.7 billion dollars / year).

🎁 The complete list of +200 active web3 grant programs is offered to you as a bonus at the end of the article. 🎁

But how can you make a success of your application ?

Here are the 5 most common mistakes that web3 entrepreneurs make, and which lead to the refusal of their grant requests.

1- You’re looking the wrong way

Regarding the timing, it is a mistake to wait for the bull market to resume in order to apply for grants. Because no one knows how to time the market and because bull market also means way more projects to apply. From experience, even if the envelopes of foundations are lower in a bear market, the chances of success of applications are also much higher.

Namely also, foundations' investment theses are bound to evolve according to the health of the Crypto market.

Thus, in a bear market, when it's difficult to attract new users to blockchain, web3 projects aimed at non-web3 users are favored, enabling the creation of new wallets and continued adoption even in an unfavorable context like SocialFi, GameFi, or web3 seamless projects (Wallets / NFT Marketplaces, etc..).

It is the opposite in the bull market, it doesn’t mean that DeFi, tooling or Infra. will not receive grants in the bear market, but the health of the market does indeed impact the investment theses of the foundation (we are currently at a sweetspot, no thesis being favored due to the recent resumption of the bull market).

2- Don’t batch your applications

Blockchains understood that adoption would also come from cross-chain projects, so it's very common to get grants from several foundations, but foundations don't expect the same thing from applications.

Even if 2 blockchains share the same investment theses, one may very well be interested in the innovative side of a project, while another is attracted by the project's capacity to be a facilitator of adoption for its ecosystem.

It's therefore essential to tailor your application to each grant program you're eligible and applying for.

Tailoring each application to align precisely with the unique requirements of individual grant programs is truly the cornerstone to improving your chances of success.

Expanding on this point, it is crucial for applicants to conduct thorough research into the specific preferences and criteria of each foundation, with information directly accessible on the foundations' respective websites.

3- Aim for traction before applying

In the current market, foundations seek more than promises; they crave reassurance from projects that demonstrate real-world potential. It is prudent to validate a project's interest before embarking on the application process.

While possessing a substantial customer base is not an absolute prerequisite, the showcasing of traction plays a pivotal role in building the much-needed confidence among foundations potentially interested in investing.

This does not necessarily mean that the project must be followed by 2k users on Discord & 10k followers on Twitter, but around 50 active & engaged daily members on the Discord on a BtoC project or letters of intent from around 10 of partners/customers on BtotB can definitely reassure investors.

4- Applications are often poorly designed

Foundations are over-solicited, with dozens of applications on their online forms every day. Time needs to be spent on the application & certain key elements need to be included.

An application that fails to present a pitch deck, the technical stack, a complete budget, and detailed milestones, will usually be automatically rejected.

Foundations deplore the fact that most applications have missing or incomplete elements.

5- Do not use online forms on foundation websites

(if possible)

This may seem counterintuitive, but you should not use online forms.

As explained previously, foundations are over-solicited, and applications can also be rejected due to lack of time to analyze them. It is in fact often very difficult to fully explain the value of your project through an application submitted on a form.

This certainly explains why the success rate of spontaneous applications via the forms on the foundations' website is < 1%.

This is even more true for grant programs that operate quadratically as is the case with the Polygon Village program, the decision being made by the Polygon community, and not by a grant committee as for other programs.

It is therefore always better to favor contact with a member of the grant committee or direct exchanges with the community in the case of a targeted quadratic program, in order to be able to communicate in the best possible way on your project while clearly explaining the benefits that the protocol would have in subsidizing you.

At 0xLabs, this is what we have been doing for over a year, after helping our clients put together their application file, we connect them directly with the grant managers of more than 80 foundations with which we work: (Polygon Labs, Tezos, Immutable, Ethereum, The Arbitrum Foundation, NEAR Protocol , AAVE, ...) thus putting all the chances on their side to obtain WEB3 subsidies

Wishing you good luck in your applications!

Do not hesitate to contact me on Linkedin for any requests / questions.

Bonus :

Most Complete & Updated Web3 Grants List : here

2 major evolutions we observed recently 👀

The markets are stirring, ICOs are making a comeback, perhaps a new cycle is beginning. What will evolve in the way web3 projects are conducted? We observe 2 major evolutions :

1- Rebalancing of power relations between web3 developers and projects

In the previous cycle, blockchain developers were clearly a rare and expensive commodity.

Qualified profiles were rather scarce and monopolized by the biggest projects with unlimited budgets. Those who wanted to hire a Rust developer, for example, were quickly in competition with players like Parity.

Since then:

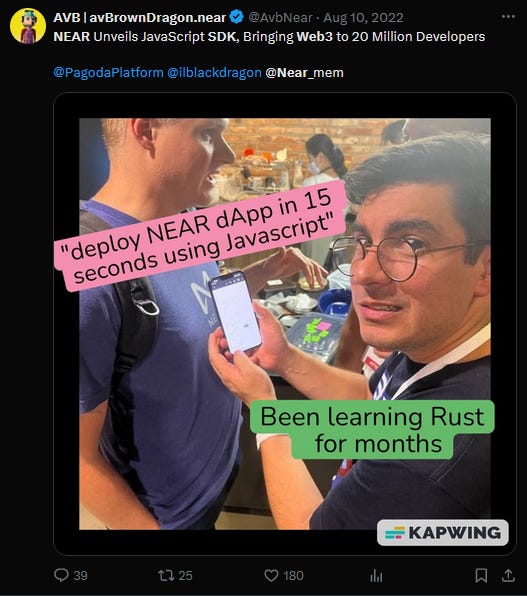

o Infrastructure blockchains like NEAR PROTOCOL have multiplied SDKs and tools to enable the construction of dApps with commun languages or even in no-code.

o The offering of training on web3 languages has exploded, attracting candidates wishing to benefit from attractive salaries.

o The web3 giants have released a large number of experienced talents.

The best developers will, of course, be sought after, but we predict a much less severe talent shortage.

2- Strengthening of transparency requirements and control for the community

Communities have advanced in their analysis of on-chain transactions, and new tools are available for them to easily observe the management of a token by its project.

This results in the demand for more balanced models that are less focused on compensating influencers.

For instance, the on-chain analysis startup Bubblemaps had highlighted the significant volume of tokens dumped during the launch of Satoshi VM.

Taking care of your community will not be an option :-)

If you come to Paris Blockchain Week, don’t hesitate to book a coffee slot with us by sending a message on our Telegram ☕.

If you like our work, feel free to like and comment.

Follow us on Linkedin to keep up with all our news.

Disclaimer : The goal of this newsletter is to inform and produce content related to management in the world of Web3. It is not investment advice. Investments in crypto-assets and NFTs are risky and can result in the loss of your entire capital. Always conduct your own research and exercise caution.